The technology behind Carta Liquidity offers private companies the ability to customize their liquidity programs based on their specific needs and objectives. Built with a tight integration into Carta’s ownership platform, and compensation services, Carta Liquidity allows for efficient and accurate transactions that leverage and seamlessly update the source-of-truth data in Carta. This vertically integrated offering is positioned to serve as the financial infrastructure for the private markets as they continue to evolve.

A surging secondaries market

As discussed in the Carta 2021 liquidity report, the market for secondary liquidity in private companies is booming. The reasons for the surge are numerous but relate to a secular shift in the private markets. To capitalize on the growth of pre-IPO companies, investors are deploying capital in both primary fundraises and secondary liquidity offerings, particularly as high-growth companies stay private for longer. In 2022, these trends have become more apparent amid a backdrop of impending interest rate hikes by the U.S. Federal Reserve to combat rising inflation.

Even as later-stage investors demand higher exposure to equity in private companies, early-stage investors have become increasingly interested in liquidity opportunities to return capital to their limited partners, or to redeploy capital in other innovative, early-stage companies. Secondary transactions can help both parties satisfy their goals: Early investors can sell their shares at attractive valuation multiples, and late-stage investors gain exposure to premium, high-growth assets. Companies have also used these transactions as a catalyst for employee liquidity opportunities, giving buyers an opportunity to increase their exposure and potentially blend down their acquisition costs. 1

Innovative liquidity mechanisms

Until recently, mechanisms for executing liquidity transactions did not evolve at the same pace as demand. Carta, a leader in equity management, first entered the private market liquidity landscape in 2017 with the launch of its tender offer product. Recognizing the demand for greater control and flexibility in secondary liquidity transactions, the company then launched Carta Liquidity as a platform for offering an expanding array of customizable liquidity solutions.

In addition to a suite of transaction types powered by a user-friendly tech platform, the Carta Liquidity team is able to offer clients expert advice on the design of their secondary transactions. The Carta Liquidity team can help companies understand what levers may impact their valuations or sellers’ tax outcomes during a secondary, gain insight into how their peers are structuring their liquidity programs, and review best practices emerging in the market.

As private companies at different stages of their life cycle begin the process of designing customized and streamlined liquidity programs to meet their specific needs, the Carta Liquidity team guides decision-makers through the primary levers at a company’s disposal. These are:

-

Shareholder eligibility

-

Investor composition

-

Transaction price and size 2

-

Transaction timing

-

Transaction information & disclosure materials

-

Transaction framework

Introducing customized liquidity transactions

Carta Liquidity partners with private companies at all stages to provide liquidity for their employees and other shareholders while also expanding companies’ access to investors through the Carta Liquidity network of institutional investors.

For any transaction conducted on the Carta Liquidity platform, the Carta Liquidity team of specialists partners with companies on how to:

-

Structure a customized transaction within the parameters determined by the company

-

Conduct cap table quality assurance and participant due diligence ahead of the transaction launch

-

Aggregate supply from eligible sellers and demand from eligible buyers through a user-friendly online portal

-

Provide transaction documents and disclosures securely to all eligible participants, and collect signatures from participants to execute agreements through the online portal

-

Settle the transaction, collect capital from buyers, collect option exercise fees, withhold for tax obligations, distribute proceeds to sellers, and seamlessly update the company’s cap table

By combining customized transactions and a robust platform offering with expert guidance, Carta Liquidity is able to help companies achieve their underlying liquidity goals with less effort and cost.

Additionally, as the SEC refines and implements its 2022 private markets agenda—geared specifically at increasing transparency via more disclosure requirements, encouraging more companies to go public, limiting investor access, and imposing additional requirements on raising private capital—private companies will need to understand the regulatory landscape.

Carta Liquidity’s distinctive approach to creating customized transactions and Carta’s team of policy experts help clients navigate the ever-evolving regulatory environment.

Transaction participants

Shareholder eligibility

Shareholder eligibility is one of the first decisions a company makes when customizing a liquidity offering on Carta Liquidity. Some transaction frameworks, such as tender offers and auctions offer the flexibility to include multiple buyers and seller types, whereas other transaction types like negotiated block trades are typically designed to involve a single buyer and seller.

Larger transactions with many buyers and sellers can be more efficient since their size enables collective buy and sell interest to be more easily incorporated into the resulting transaction price and/or size. Companies might prefer these types of transactions if they intend to maximize the number of participants in the transaction. Motivations for maximizing the number of participants in a transaction can include providing liquidity to employees as part of a company’s talent retention and acquisition strategy, or establishing an updated price for the company’s stock through an auction process.

Regardless of a company’s goals, the technology platform that underpins Carta Liquidity allows companies to easily centralize participants in a single transaction with a single set of transaction documents and disclosure information. Transactions with fewer participants—sometimes as few as a single seller and buyer—allow for faster execution and greater negotiation power between the transaction participants. These transactions can be beneficial to companies that wish to restrict the number of investors gaining access to their cap tables while simultaneously satisfying choice shareholders’ desire for liquidity. Each transaction is governed by its own set of transaction documents and disclosure information.

The Carta Liquidity platform seamlessly automates these documents from standardized templates created in consultation with each company. This means companies can scale the liquidity offered with minimal administrative burden.

Ultimately, once companies determine the size of a transaction, they then approve the list of eligible shareholders, equity classes, equity award types, and participation maximums for each seller. When customizing transactions with a large number of sellers, the number of eligible seller types (e.g., employees, ex-employees, investors, etc.) may be a factor in determining the tax treatment for the transaction. In transactions with a broader set of eligible seller types, sellers are more likely to receive capital tax treatment, rather than less favorable ordinary income tax treatment.

Finally, the number of sellers and their relationship to the company may also influence the transaction’s impact in the next 409A. Broader transactions involving sellers who are not employees will generally have more impact in a 409A valuation. This tension between tax treatment and 409A valuation impact is often where companies tweak transaction parameters to achieve the right balance for each.

Investor composition

Also among the first steps in customizing a liquidity offering is deciding which investors will have access to the transaction and its corresponding disclosures. For a tender offer, companies typically have the buyer or buyers already selected. If not, the Carta Liquidity team can help source buyers from the Carta Liquidity network. The relationship of buyers to the company is another factor in determining tax treatment for a transaction. When the company or existing investors purchase stock, the transaction is typically considered compensatory and sellers receive less favorable ordinary income tax treatment. Alternatively, the Carta Liquidity team can help source buyers from the Carta Liquidity investor network to provide greater diversification and positioning for capital tax treatment.

For a Carta Cross auction, companies approve a tailored list of institutional investors from the Carta Liquidity network, identify investors from their own network, or a combination of both. The Carta Liquidity Investor Coverage team then filters investors to eliminate conflicts of interest and creates a finalized list of investors for the company’s approval. These investors can see the company’s disclosure materials via a secure data room provided by Carta Liquidity and then have access to purchase shares in the transaction. Companies can also set participation limits per investor to limit the overall buying power of a particular participant.

This control over participant eligibility and investor access allows companies to curate the supply and demand of the liquidity offering, with considerations for tax treatment and 409A valuation impact. It also allows for greater shareholder incentive alignment within and across transactions.

Transaction price and size

Companies can select from a range of options on Carta Liquidity to identify a transaction price and/or size.

Fixed-price transactions

On one end of the spectrum, companies or third parties can set a fixed transaction price and invite shareholders to trade at that price in a traditional, single-priced tender offer or facilitate a block trade. In the case of a tender, the offer identifies the maximum number of shares or maximum amount of capital that buyers will allocate in the transaction. 3

Shareholders are then invited to tender their shares in an effort to discover how many of them are willing to sell at that price. A fixed-price transaction increases price certainty for the company, buyers, and sellers. All parties know the price and can evaluate their decision to participate upfront.

Particularly in a tender offer, a fixed transaction price does not necessarily provide certainty of allocations to buyers or sellers. In cases where the number of shares to buy and sell is not equal at the conclusion of the offer, the price does not move, which means certain sellers or buyers will either not participate, or will buy or sell less than their desired amount. We measure this balance of buy and sell interest through a metric called the subscription rate; specifically, this is the total tendered sell interest divided by the total offered buy interest. In 2021, the median subscription rate for undersubscribed tender offers was 62.9%. 4

Said differently, on average, if an investor offered to purchase $100M of stock at price X, shareholders were only willing to sell $62.9M at that price, therefore the investor was only able to purchase 62.9% of their desired investment amount, leaving $37.1M of unspent investor capital at the conclusion.

Transactions with a price range

The tender offer subscription rate results from the fact that liquidity is a function of price. When shareholders are unwilling to sell below a certain price and buyers are similarly unwilling to pay that price, those participants will not transact, and the liquidity program will deliver a less-than-optimal outcome. If investors see the growth potential of a company, they may be willing to bid at higher prices to find blocks of stock that shareholders are willing to part with.

Therefore, companies can also approve a price range set by Carta Liquidity for a liquidity program. Companies can configure the transaction to occur only within this customized range, which eliminates the potential for an appearance of a down round or a resulting valuation that is too rich.

To discover both the transaction price and size, the Carta Liquidity team can run a traditional book-build process by collecting indications from buyers and sellers within the predetermined range or run an auction by collecting firm orders from buyers and sellers. These processes identify the transaction price based on the information received from buyers and sellers and are designed to set a price where buyers and sellers have the greatest shared interest in trading. 5

These processes are designed with price flexibility, so buyers can choose to unlock additional supply by bidding higher. The Carta Cross auction functions in this manner. Carta and EquipmentShare both used the Carta Cross auction to gain greater insight into their valuations through the auction’s price discovery, as well as offer their employees an opportunity to realize the value of their equity.

While not used extensively in private markets, dutch auction tender offers, typically used by public companies to buy back stock, also function in this manner. Carta Liquidity stands ready to execute these transactions, as companies and investors seek to identify transaction pricing that maximizes the return on the company’s investment in time and resources when structuring liquidity events.

Transaction timing

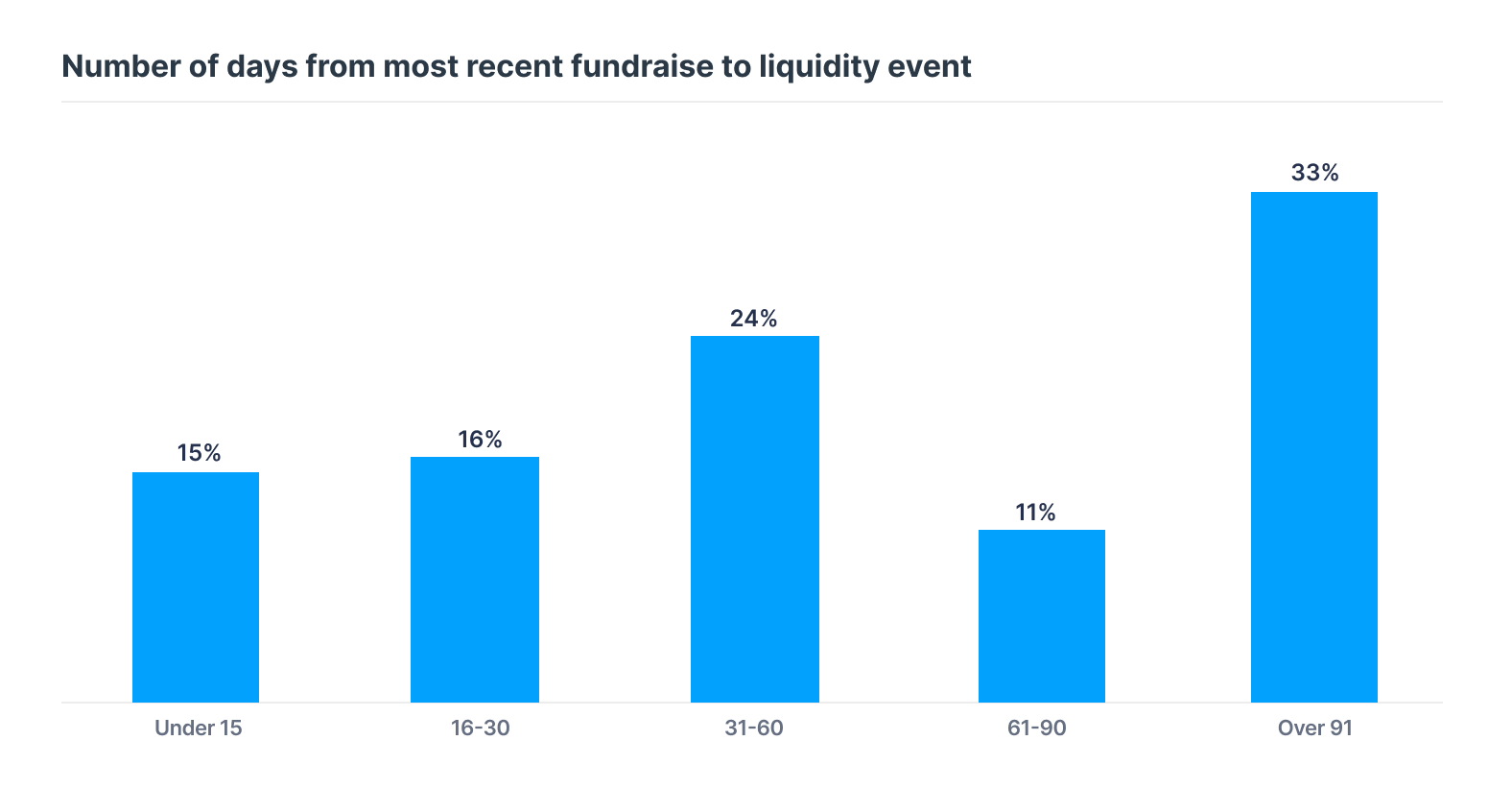

Two-thirds of secondary transactions conducted by Carta in 2021 were initiated within a quarter of the most recent fundraise. Of those transactions, 31% occurred within one month of the latest fundraising event, demonstrating the close connection between rounds of primary fundraising and secondary liquidity transactions.

While the timing of a secondary liquidity event is largely driven by excess demand from a recent primary capital raise, companies also have to consider the implications of the timing of a secondary transaction.Timing may apply to the timeline for a single transaction or the timeframe during which a series of transactions will be conducted. For example, a Carta Cross auction has a default timing of 13 business days from launch to settlement, but is adjustable to meet the needs of the company.

On the other hand, Carta Liquidity can facilitate block trades between buyers and sellers in just a few days or over several months. Lastly, tender offers must have the offering period open to sellers for a minimum of 20 business days, and generally have a settlement period that may last as long as 10 business days. While timing is generally driven by the transaction framework, companies have the ability to adjust trading windows or target a specific launch date to meet their needs or the needs of participants. For example, companies are typically targeting a specific close or settlement date before the end of the calendar year to lock in gains for that tax year, or target settlement before mid-April to help their employees cover their tax obligations.

Another consideration around repeat transactions, specifically for companies that conduct buybacks or allow existing investors to regularly purchase equity from employees through company structured tender offers, is the potential for triggering liability accounting for the company. The classification of share-based awards within stockholders’ equity is based on the presumption that those awards will be settled in equity. Companies that establish a pattern of repurchasing equity awards before the grantee is exposed to the risks and rewards of share ownership for a reasonable period of time (i.e., shares held for a period of less than six months after vesting and, if applicable, exercise) may suggest that these “immature” awards were modified to provide for cash settlement. As a result, this pattern could result in all equity awards in the company’s equity plan being classified as a liability rather than as equity.

The Carta Liquidity team helps companies consider the appropriate timing, investor composition, and structure, as well as provides insight into any adjustments that would help foster the goals of the company’s liquidity program.

Transaction information & disclosure materials

Based on the company’s goals and preferences regarding participants, pricing, and timing, as well as considerations around tax, valuation, and accounting impacts, companies then work with the Carta Liquidity team to identify one that best suits their needs. Each transaction framework requires different levels of information for and disclosure to participants, and has different levels of risk that the company undertakes.

Transaction information

Once the transaction framework is identified, the Carta Liquidity team guides the company through collating all the relevant information for the various transaction stakeholders. Depending on the needs of the company, the Carta Liquidity team may take a more active role in this process to help the company tell its equity story to potential investors, highlight the metrics and KPIs that demonstrate the company’s growth, and illustrate the company’s position in the market relative to competitors. Combining these assets with the parameters of the deal, the Carta Liquidity Equity Capital Markets team produces a comprehensive set of materials for the company’s review and approval to position the company for a successful transaction.

Disclosure materials

The tender offer framework provides a predetermined foundation for buyer participation, transaction timing, and the disclosures required to conduct the transaction, while bilateral transactions are more flexible and customizable in each of those areas.

Tender offer disclosures

Section 14(e) of the Exchange Act is the antifraud provision for all tender offers. It prohibits fraudulent, deceptive, and manipulative acts in connection with a tender offer.To comply with anti-fraud rules ( SEC Rule 10b-5), industry best practice is to disclose:

-

company bylaws

-

summary cap table

-

latest 409A valuation

-

employee option plan

-

audited financial statements for the last two years, along with a description of risk factors and forward-looking financial projections.

As discussed above, tender offers must be open for a minimum of 20 business days for sellers to review the disclosure materials and make a determination about their participation. Tender offers also require all buyers to commit to a firm offer to purchase a predetermined amount of stock. Buyers cannot amend this offer without giving sellers at least 10 business days to understand the impact of the change and make any adjustments to their sell orders.

Bilateral transaction disclosures

The Carta Cross auction and block trades are types of bilateral transactions on Carta Liquidity. Bilateral transactions on Carta Liquidity leverage Section 4(a)(7) as the default exemption from registration, but may also rely on Rule 144A or Section 4(a)(1 ½). The disclosures required under these exemptions include information such as:

-

Company’s name, place of business and business description

-

Company’s officers and directors

-

Company’s capitalization

-

details of the securities being offered

-

balance sheet and profit and loss statement for the last two years

-

additional information, such as fees and commissions, selling control persons, etc.

From a timing perspective, bilateral transactions may transpire over days or weeks, depending on the transaction framework. Buyers may also have a wider range of participation options depending on the transaction framework used.

Capital markets services aligned to a company’s goals

While the liquidity solutions and customizations available to companies on the platform are extensive, the Carta Liquidity team of capital markets experts focuses on leveraging Carta’s extensive private market data, like the Carta 2021 liquidity report, to bring analytics to the forefront of all client engagements.

To drive seamless transaction execution from onset through settlement, the capital markets team provides a variety of services:

-

Secondary trading analysis: Carta Liquidity’s integration with Carta’s core equity management software allows the Carta Liquidity Equity Capital Markets team to analyze a company’s recent secondary trading activity and provide insight on price and size for a potential transaction.

-

Seller eligibility model: The Carta Liquidity Equity Capital Markets team analyzes a company’s cap table to understand the eligible pool of sellers for a liquidity event and help determine which transaction framework would best suit the company’s goals.

-

409A impact analysis: Carta Liquidity partners with Carta’s Valuations team to help companies understand the impact secondary transactions will have on their valuations, as well as how they can design liquidity events that align with the company’s goals.

-

Market intelligence & insights: Carta Liquidity leverages Carta’s extensive private markets data to determine the key liquidity trends driving the market and understand how to navigate evolving market dynamics.

-

Deal messaging & communication: Carta Liquidity centralizes deal messaging and communication across transaction stakeholders through one deal team focused on highlighting the offering’s key investment theses and metrics to investors, as well as overseeing the transaction process smoothly from inception to settlement.

Embracing private market liquidity

The sheer growth of private capital, increasing demand for liquidity, and an aggressive SEC agenda indicate that private markets will continue to evolve in 2022. To meet these changing conditions, the suite of liquidity solutions available on Carta Liquidity, with its direct integration into the source-of-truth cap table, compensation, and tax data at Carta, are coupled with our seasoned team of capital markets professionals, all focused on empowering companies to design customized liquidity programs that achieve their goals.

Footnotes

1 Typically buying common shares from employees and ex-employees at a discount to preferred, thus blending down the cost of acquiring stock

2 For fixed price transaction offers

3 The offer to purchase made by buyers is firm commitment and cannot change without providing an appropriate notice period and potentially extending the timeframe of the transaction

4 Aggregate statistics of transactions on Carta, Inc. and Carta Liquidity.

5 Also known as the volume maximizing price (the price at which the most shares can trade)